Thomas considers himself a “sales-oriented” credit manager. Credit has to support sales, he said. “It should always be the focus of a true credit professional to facilitate sales growth for his company at a level of risk that is acceptable for the owners and stakeholders,” he added. “It is vital that you are involved in the strategic plans of your company, and I have always asked to be a part of that. After all, who knows more about the financial condition of their industry than the credit managers who are analyzing and assessing the company’s customer base?”

What’s an Association to Do? Thomas plans to guide and motivate board members in line with NACM’s mission, goals and strategies to help the board chart a course that meets and exceeds members’ needs. “The chairman should be a voice for the membership to the association and a voice for the association to the board,” Thomas said. “I love speaking with other members and affiliate managers about the issue and challenges they face.”

Staying relevant will help strengthen the organization’s position as the voice and advocate for business-to-business credit in the business community worldwide, he added. Steps that facilitate this will help add members, and the association needs to find more ways to reverse the downward trend of membership, while providing suitable, innovative and valuable resources.

Thomas does not want to just grow membership, however. He is hopeful his strengths as a relationship builder will help him inspire more members to participate and become involved in the association’s services and programs. “I want to encourage people to step out of their comfort zones and become part of the process,” Thomas said, who wants to see more members take advantage of what the organization has to offer. “It’s an invaluable resource. Not enough people take advantage of it.”

Thomas strives for excellence for himself and those whom he supervises. “My biggest challenge has been to constantly make sure that we have the essential tools, the best resources and the proper training to help us succeed in a fast-paced environment. I am constantly looking for ways to improve our processes and help our staff succeed. I always remind our staff that they should not only be doing their best to add value to our company, but it is just as important that they work to add value to their professional and personal lives as well. I have found that the two go hand in hand in defining successful people. If you want to keep yourself valuable and relevant, you have to grow and improve yourself,” Thomas said. The pace and demands could create stress and burnout, he noted. “I am constantly asking for feedback and do my best to make sure that we all keep the proper balance in our lives.”

With nearly 15,000 members, the association has access to lots of great experience, Thomas said. “Our membership has an incredible amount of talent. We need to find ways to leverage membership.” One such way is to grow mentorships within the association. Relationships and networking provide opportunities to share knowledge with less experienced credit professionals. “Business-to-business credit is becoming more relevant and will always be a part of our economy. This makes NACM relevant for new credit professionals because they’re the future for B2B credit and their industry.”

Thomas’ service on his affiliate’s board of directors provided him with a view of the association’s inner workings, which ultimately led him to pursue service on the national board. “Serving on the board has given me a new perspective about the importance of membership and the involvement of membership,” he said. “This is a member-governed operation for the benefit of members. I don’t understand why you wouldn’t be involved.” He assumed it is because people either do not know their participation is welcomed or they need encouragement. His message to members, he said, is “Step out of your comfort zone. Your association needs you. The reward will far exceed your expectations.”

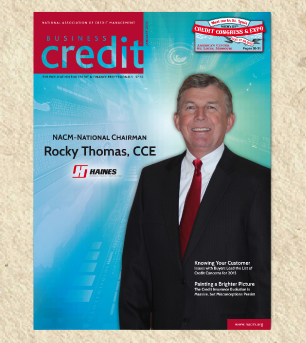

ROCKY THOMAS, CCE Chairman, 2015

Value to one’s company comes, in part, from making yourself relevant to your profession and to your industry, said Ben “Rocky” Thomas, NACM’s new chairman, and relevance comes from keeping yourself current with the tools and processes that will help your business succeed. That’s where the association can help, Thomas added. “I don’t know where I’d be professionally without it.”

Thomas’ membership has helped make him a vital part of the companies that have employed him. In fact, Thomas credits his association ties with helping him to be a part of building North America’s largest flooring distributor. “My skill set has directly contributed to the growth of our company.” CMH Flooring Products, Inc., where he served as vice president of credit and financial services for more than 16 years, recently merged with J.J. Haines Co. to form a business with nearly $500 million in annual sales. “I’ve been on both sides of the merger and acquisitions process,” Thomas said. “This is by far the largest and most detailed.

”Despite the size of the merger, Thomas felt at ease with the process because he already had a professional connection with the other firm. Both Thomas and Haines’ vice president of credit were long-time NACM members with CCE credentials. Although neither had met nor spoken with each other previously, “when you have those credentials, you already know you’re both professionals,” said Thomas, who will serve as the director of credit—South for Haines. NACM “gave us a foundation, and we knew that there was a common level of expertise and professionalism.”

As chairman, this is one of the messages he hopes to convey to members and prospective members. The association provides credit professionals with a connection, helps breed confidence and builds pride, Thomas said. These are important attributes because “accounts receivable management and cash flow are key components of a company’s success. The proper use of business-to-business credit and the effective management of the order-to-cash process are key elements and essential to the growth and success of any company. Credit management is always going to be a vital part of a company or enterprise.” He also views the most important function of credit as being a facilitator of growth; it is about becoming partners with customers as well as a firm’s sales and marketing teams, he added. “I quickly realized the importance of my role and wanted to make sure that I had the knowledge, training and expertise to help my company grow and to continue to play a role in that growth.” In addition, “If our customers are successful, then we are successful. I find great satisfaction in working with our sales organization and getting to know our key customers and partnering with them to help them succeed. I really enjoy the relational aspect and being able to play a key role in my company’s strategy.”

Thomas migrated toward credit while working at a flooring company as he earned his bachelor’s degree in business management from Georgia State University. He charted his own course into business-to-business credit by combining his accounting and finance knowledge and his skills as a relationship manager and negotiator with the resources he has taken advantage of by being an active member of NACM since 1982.

Thomas considers himself “a poster boy for NACM. I’m a prime example of someone who grew in the credit industry through the skills I gained from the association.” Prior to becoming a member, “I knew nothing about credit,” he said. Thomas cut his teeth by joining his local affiliate, NACM-Southeast. Over time, he became more involved. “I would not be where I am without the education, the resources and the experience provided by this association. It has been an invaluable part of my professional and personal growth. NACM is where I got my education in the art of credit management.”

Thomas has served the commercial credit community for more than 25 years on local and national levels and has also attended and participated in NACM’s Legislative Conference in Washington, DC, actively lobbying for the commercial credit community. In 2001, his local affiliate named him Credit Executive of the Year. Professionally, Thomas has had responsibility for all extension of business credit, risk management, accounts receivable management and the order-to-cash process, which is essential in creating timely cash flow for your company, he said. “I have helped write and implement all policies and procedures in these areas, and I have had to make some very difficult decisions and have been involved in some very challenging circumstances throughout my career. I hope that I always not only show professionalism, but graceful professionalism.”

Challenges and Opportunities

Business decisions today occur quickly, Thomas said. “The pace of business requires quicker decisions, but we can’t let that result in poorer decisions. We need the resources and technology to do that. As credit professionals, we have to be more diligent—more knowledgeable—about financing.” In addition, the credit community is shrinking by going global, Thomas said. “Domestic and international credit lines are becoming blurry. It’s more important than ever that you keep yourself up to date.”

Without the efficient use of business-to-business credit, both domestic and international economies would be severely affected, he said. “We are constantly looking for ways to do more with less and finding the information, the tools and the services to make sound credit decisions in a real-time environment,” Thomas said. “We must listen to the needs of the credit community and find ways to provide these resources.”

Manufacturers and distributors have an opportunity to work more with customers. “Although banks will always play a role, lines of credit have diminished. The banking crisis has made it essential for us to be more of a resource for our customers. Businesses are playing a more important role in financing their customers.” Without B2B credit, most companies would have a serious liquidity issue, Thomas said. (Trade credit represents 70% of financing for small business, according to the National Small Business Association, and outstanding trade credit represents nearly 20% of the annual US gross domestic product for fourth-quarter fiscal 2013, according to the Federal Reserve.)